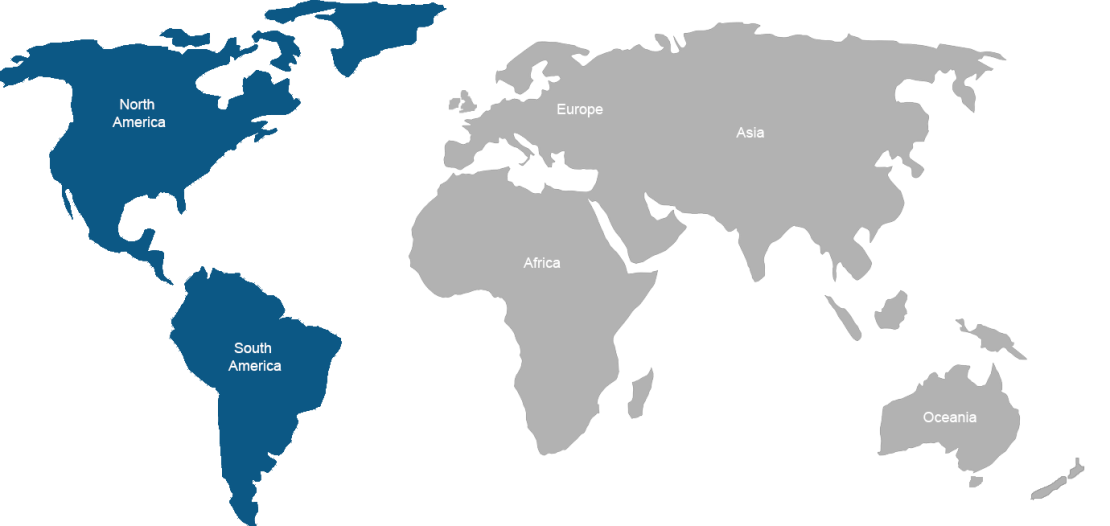

Americas Research & Development Incentives

Innovative companies are playing key roles in their national economies, with research and development investments made by business being substantial drivers of growth and prosperity for nations. Due to this R&D incentive regimes are being reformed world wide at an unprecedented rate to accommodate and attract highly innovative companies to invest in their economy.

Many countries promote and encourage R&D operations in their economy as part of strategic plans to increase research activities and develop their nation. Countries which offer R&D tax incentives are considered favourable locations for internationally-mobile R&D companies.

The R&D Tax Credit, is a general business tax credit under Internal Revenue Code section 41 for companies that incur research and development (R&D) costs in the United States. The credits are a tax incentive for performing qualified research in the United States, resulting in a credit to a tax return.

The Canadian government administers a federal Scientific Research and Experimental Development (SR&ED) program. This program is a tax incentive designed ot encourage economic development and job creation in Canada.

The Brazilian Government is a strong supporter of R&D activities, with the Government creating a tax incentive for R&D commencing in 2006. Currently available to the Brazilian market is super deductions to taxpayers with eligible expenses, financial support to new R&D investments and accelerated depreciation on qualifying R&D assets.

The general corporate income tax rate is 30%. Although R&D incentives were eliminated as part of Mexico’s 2010 tax reform, the legislature has allocated funds to extend R&D grant programs to provide direct cash subsidies for qualified R&D projects undertaken in 2014 and 2015.