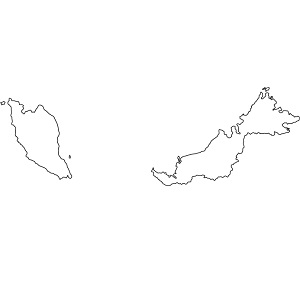

Malaysia

Description of Incentive

Tax deductions for R&D expenses incurred and an addition R&D tax credit of 25% of incremental qualifying spend of the base year can be relieved against the corporation tax charge for the period. Excess R&D credits are eligible to be refunded in cash, equating to a total tax relief of 37.5% (corporate tax rate of 12.5% and R&D rate of 25%), allowing companies a maximum refund of €37,500 for every €100,000 spent.

Services

Swanson Reed offers the following services:

- Advice on tax preparation relevant to claiming the R&D tax credits incentive

- Preparation of documents relating to filing and substantiating a R&D taxation claim

- R&D tax advice and consultations

- R&D tax claim planning and preparation

For a full range of services in relation to the credit, please click here.